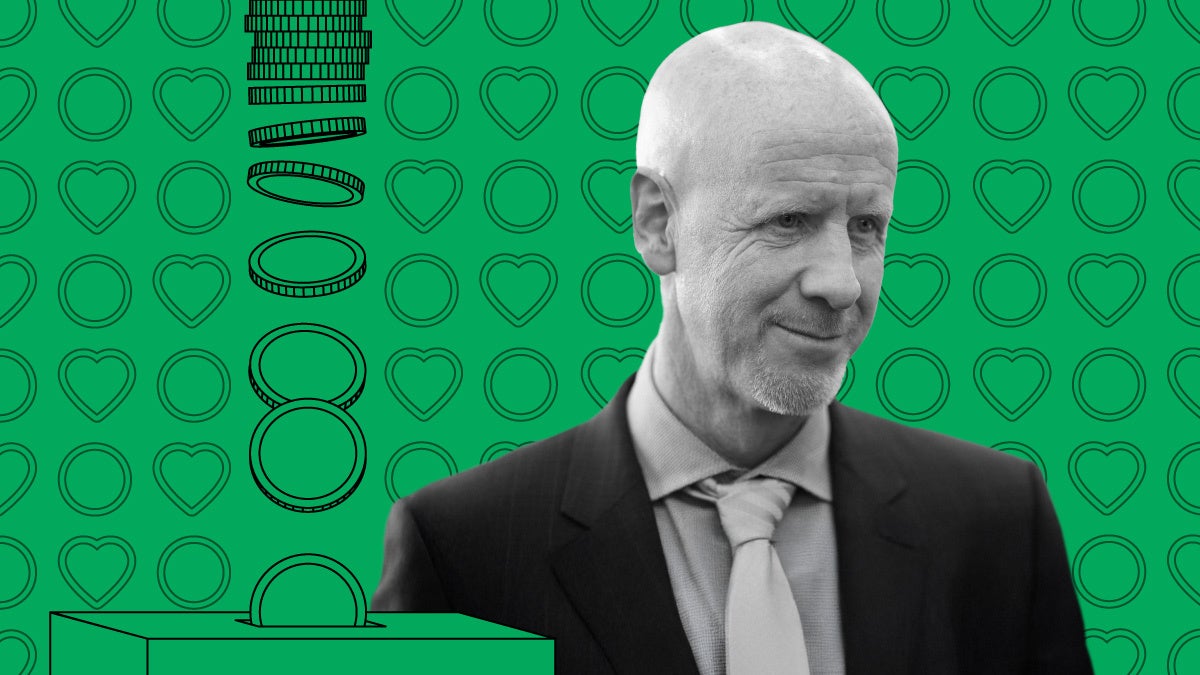

The planned $82M sale of a Miami Beach office building owned by Nightingale Properties has fallen through, leading to a legal dispute between the developer and the intended buyers. Nightingale CEO Elie Schwartz had been repaying $53M in funds he misappropriated from two crowdfunding campaigns, including one involving the Miami Beach building. The sale was a crucial part of his plan to reimburse investors. Nightingale has filed a lawsuit claiming that it is entitled to a $2M deposit because the buyers, Black Lion Partners and Massa Investment Group, failed to close the deal on time. In response, Black Lion and Massa have filed a counterclaim, accusing Nightingale and Schwartz of violating the terms of the agreement. A hearing is scheduled to address these claims.

Lawsuits Cause Nightingale’s $82M Miami Beach Office Sale to Collapse