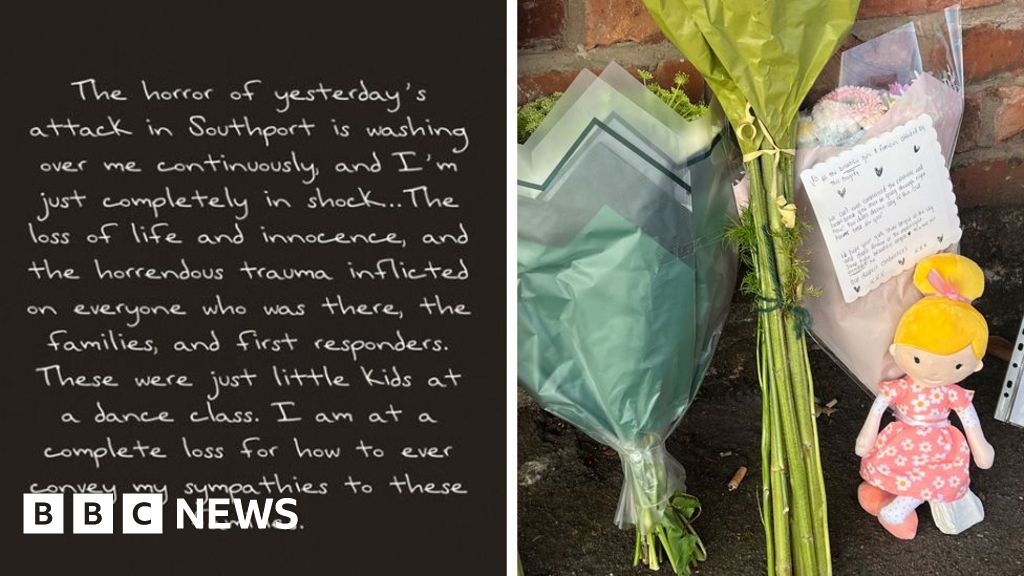

Taylor Swift in ‘shock’ over Southport attack as fans raise £100k

Her fans have raised more than £180,000 for the families of the victims of a knife attack on Merseyside. Swift, who played in nearby Liverpool as part of her European tour in June, said the “horror” …