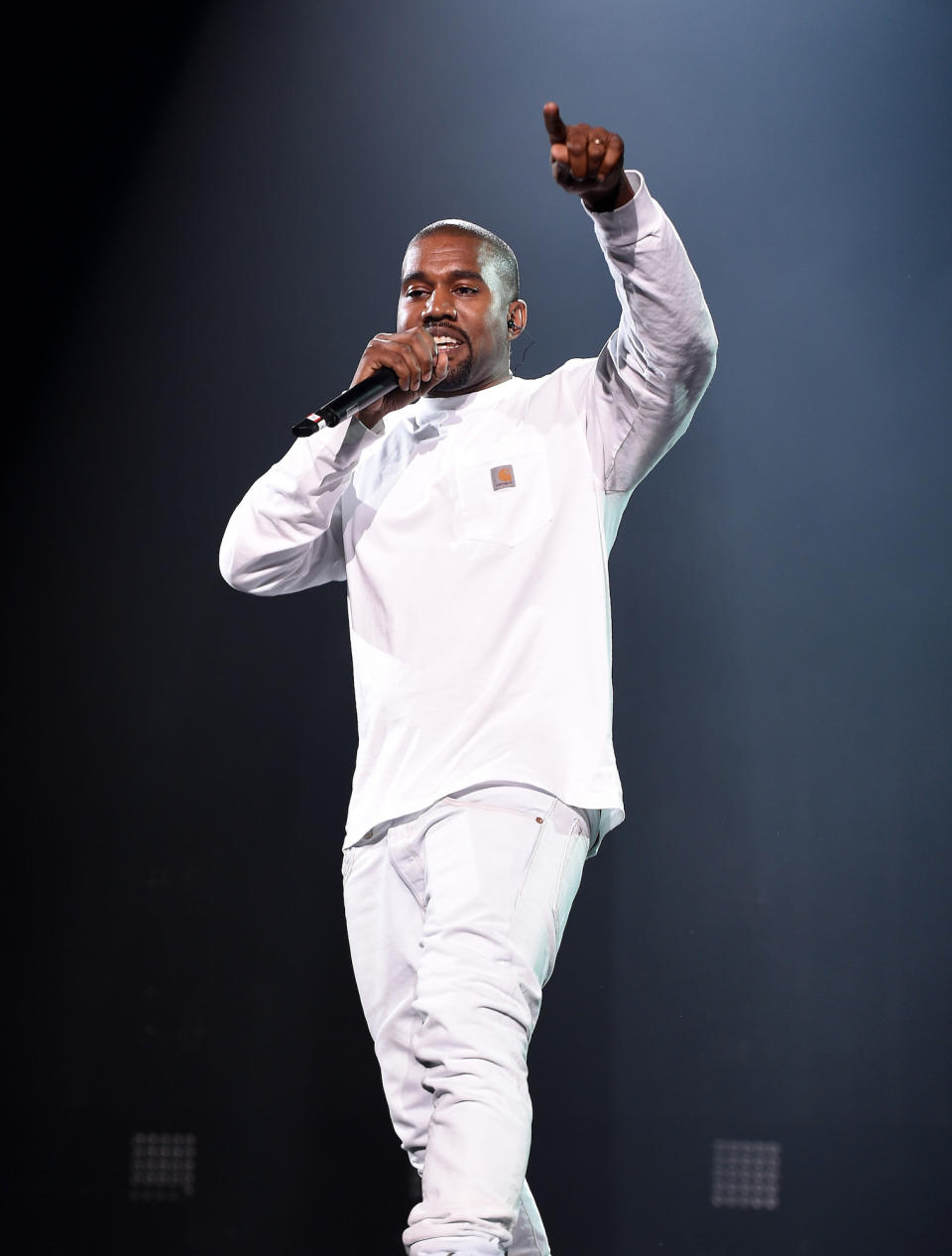

Kanye West Loses Tens Of Millions Of Dollars In Sale Of Gutted Malibu Mansion

Kanye West . Kanye West Has Finally offloaded the Malibu mansion he’d gutted, reportedly in order to create a bomb shelter – and he’s taking a major financial loss in the pr …