On Monday, October 14, 2024, Verb Technology Company, Inc. (Nasdaq: VERB) experienced a remarkable uptick, soaring by 65.94% to reach $13.13 by 11:06 AM EDT. With a trading volume of 22.93 million shares—far exceeding its average volume of 335,798—VERB is undeniably a stock to keep an eye on today. This surge follows recent developments that have put the company in the spotlight, prompting investor interest.

YTD Performance: A Tale of Contrasts

As of now, VERB’s year-to-date (YTD) performance tells a different story. The stock is down 60.95%, starkly contrasting with the S&P 500, which has gained 22.55% YTD. This disparity raises questions about VERB’s potential for recovery and highlights the volatility often seen in the tech and startup sectors.

Comparing the Two

While the S&P 500 reflects a broader market recovery, VERB’s struggles illustrate the challenges faced by smaller tech companies. However, the recent surge could signify a turning point, making it crucial for investors to monitor its next moves closely.

Understanding Verb Technology’s Business

Founded with the vision to innovate the way businesses connect with consumers, Verb Technology has carved out a unique niche. The company operates primarily through its flagship products: MARKET.live, a livestream social shopping platform, and GO FUND YOURSELF!, a groundbreaking TV show aimed at disrupting the crowdfunding space.

MARKET.live: Shaping the Future of Social Shopping

MARKET.live has evolved significantly, especially with its growing partnership with TikTok. The platform enables brands to engage customers in real-time, driving sales through interactive livestreams. Recently, the revenue model has shifted to a fixed-price, contract-based approach, emphasizing recurring revenue, which is crucial for long-term stability.

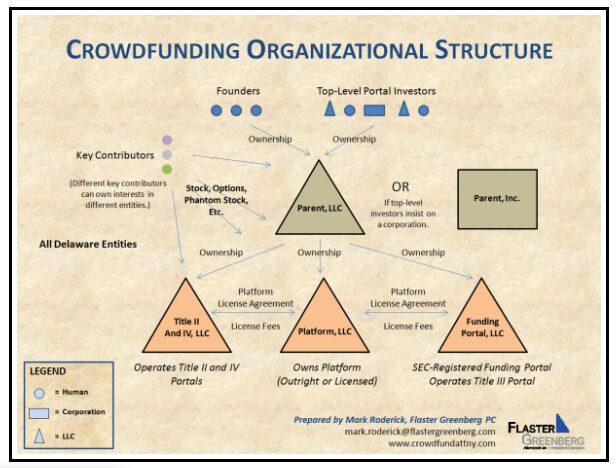

GO FUND YOURSELF!: Democratizing Investment Opportunities

In its mission to empower investors, Verb has launched GO FUND YOURSELF!, targeting the equity crowdfunding sector. This initiative not only helps issuers raise awareness for their offerings but also connects everyday investors to opportunities that were once out of reach. This dual revenue model—consisting of cash and equity-based fees—positions Verb favorably in a rapidly growing market.

A Third Mystery Business in Stealth Mode

Perhaps the most intriguing aspect of Verb’s strategy is its third business unit, which is still under wraps. CEO Rory J. Cutaia hinted that this venture represents a “potential explosive revenue growth opportunity” and is anticipated to be revealed soon. Investors are keenly awaiting more details, which could further impact the stock’s performance.

The Stockholder Perspective

Cutaia’s recent letter to stockholders emphasized the company’s financial health, stating they have approximately $17.2 million in cash with minimal debt. He expressed confidence that if the market were to recognize the company’s true value, shares could trade well above $22 based on net cash alone.

Reverse Stock Split: A Necessary Move

One of the significant decisions leading to the current trading conditions was the recent reverse stock split, initiated to maintain its Nasdaq listing. Cutaia clarified that this decision was not made unilaterally by the company but was instead a choice presented to shareholders.

Conclusion: Is Verb Technology Ready for a Comeback?

With its recent surge, coupled with a solid cash position and innovative business models, Verb Technology Company, Inc. is certainly a stock to watch. While its YTD performance reflects past struggles, the recent uptick suggests renewed investor interest and potential for recovery. As the company rolls out its strategic plans and unveils new developments, it may very well be on the brink of a turnaround.